2025 Fed Tax Table. This page provides detail of the federal tax tables for 2025, has links to historic federal tax tables which are used within the 2025 federal tax calculator and has supporting. See current federal tax brackets and rates based on your income and filing status.

For both 2025 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Federal Withholding Tables 2025 Federal Tax, The social security wage base limit is. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Tax rates for the 2025 year of assessment Just One Lap, No withholding allowances on 2025. These are not the tax rates and other numbers for 2025 (you'll find the official.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, If you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure federal income tax withholding. Page last reviewed or updated:

T130159 Baseline Distribution of and Federal Taxes; by, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax. Your bracket depends on your taxable income and filing status.

2025 Federal Tax Brackets Chart Dulci Glennie, These are not the tax rates and other numbers for 2025 (you'll find the official. The federal tables below include the values applicable when determining federal taxes for 2025.

Maximize Your Paycheck Understanding FICA Tax in 2025, The highest earners fall into the 37% range, while those who earn the least are in the 10%. And imposing a 25 percent “billionaire tax” on those whose wealth exceeds $100 million.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 2025 income tax withholding tables. They are published in revenue.

Tax Rates 2025 To 2025 2025 Printable Calendar, No withholding allowances on 2025. Indexed tax tables for 2025.

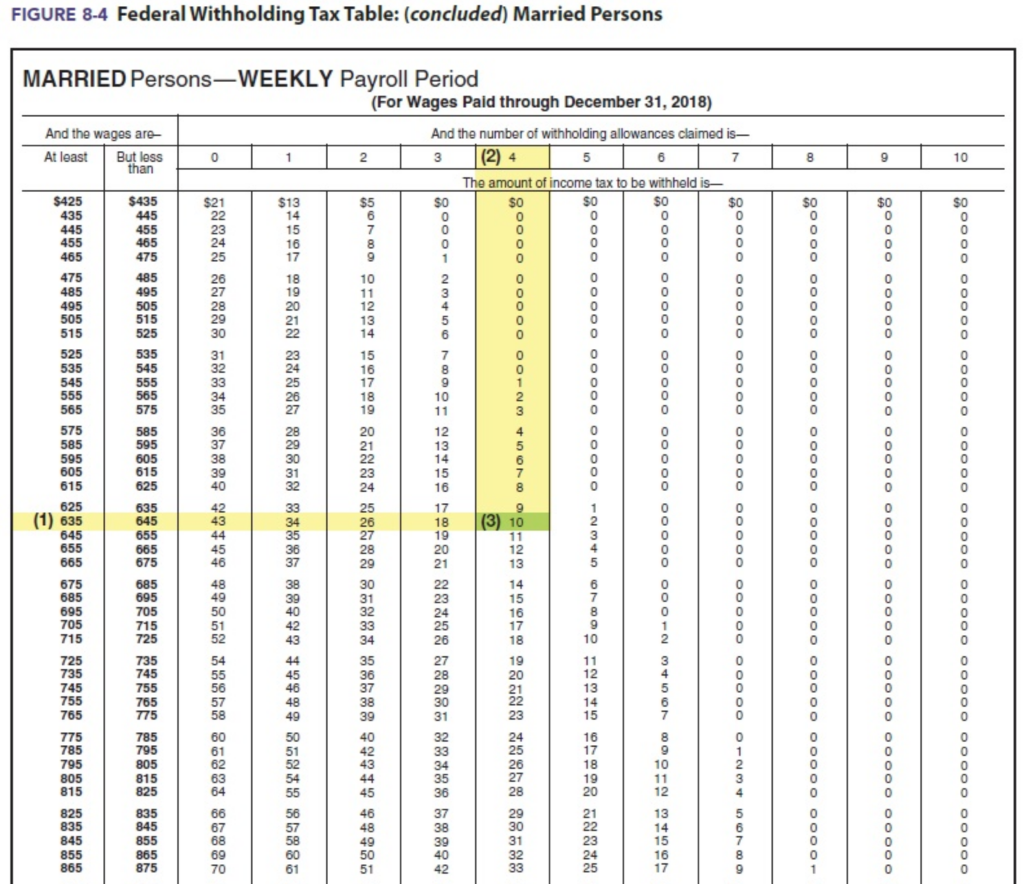

Married Federal Tax Withholding Table Federal Withholding Tables 2025, No withholding allowances on 2025. Indexed tax tables for 2025.

Federal Tax Withholding Tables Weekly Payroll Awesome Home, The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain. They are published in revenue.